In the context of strikes, public sector pressures and inflation, the news at the end of last year that the UK’s technology sector had retained its position as the most valuable in Europe (and third most valuable globally behind the US and China) was met with little fanfare.

Given the urgency of day-to-day cost of living issues, the success of our technology sector may seem secondary and unimportant at the moment. But such a view both misinterprets the shape of the sector in the UK and the role it can play in the country’s wider economic recovery.

The UK has more high-growth technology companies than any of its European peers, having created 144 unicorns (privately owned technology and software businesses valued at over $1 billion), 237 futurecorns (companies forecasted to achieve a $1 billion valuation) and 85,000 start-ups and scale-ups. Many assume that the technology sector is, by its nature, consolidated and top-heavy, but these figures show that it is in fact a thriving and growing ecosystem that touches every level of the economy. It is also not a sector concentrated solely in London – eight cities in the UK are home to more than two tech unicorns, including Edinburgh, Nottingham and Oxford, making tech one of the most promising sectors for supporting the long-term Levelling Up ambitions held on both sides of the political aisle.

A thriving technology sector also positively reinforces itself, becoming more attractive to domestic and international investors. Last year, fast-growing UK technology companies raised £24 billion, more than double their contemporaries in both France (£11.8 billion) and Germany (£9.1 billion). If the UK can retain its position as the pre-eminent technology sector in Europe, this capital will continue to flow.

With all this being said, however, there are several key challenges that the Government will need to address to ensure that the UK maintains and builds on this globally leading position. Three priorities in 2023 will be:

1. Making digital skills a political priority

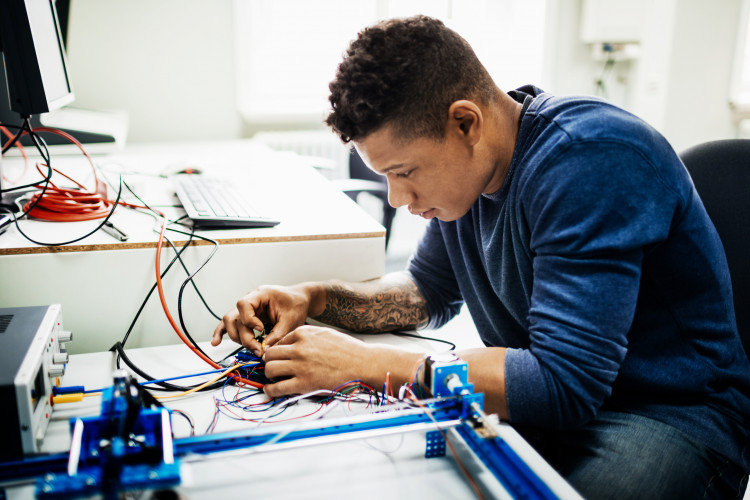

The size and breadth of the technology sector is beginning to outstrip the availability of skilled labour. Over 80% of jobs advertised in the UK now require digital skills and employers say the lack of available talent is the single biggest factor holding back growth. A House of Commons Science and Technology Committee report found that the digital skills gap costs the UK economy as much as £63 billion a year in potential GDP.

Bridging this gap must therefore be the first priority for Government in the technology sector in 2023. Continued growth becomes increasingly futile if it cannot be supported by a skilled workforce and many workers in the UK could be cut out of the job market altogether as it becomes more digitised.

The Government recognised this in last year’s Digital Strategy, setting targets, for example, to incorporate digital skills into the national curriculum, fund higher level courses such as PhDs in Artificial Intelligence and raise general awareness of how to pursue careers in tech and digital. The Prime Minister’s much-maligned policy of ensuring children are taught maths to 18 was also, at least, driven by a recognition that children will be graduating into a world where “data is everywhere”.

The extent of the digital skills gap in the UK should push policy to go further and be bolder. The Government’s ambition should be for every child in England (education is devolved so similar ambitions should be held in Scotland, Wales and Northern Ireland) to leave school with foundational skills in computing, and more should be done to encourage and support employers to equip their workforces with digital skills.

Recent schemes like Help to Grow: Digital have helped businesses access the software they need to integrate into the digital economy, but the Government should consider how this can be supplemented in 2023 with wider packages of support for businesses to train their workforces to use such software. A digitised economy must be underpinned by a digitally literate workforce.

2. Striking the right balance between regulation and innovation

The Government is in the process of introducing a swathe of new legislation and regulatory frameworks in the tech space. As we move into 2023, new regimes for data, digital markets and artificial intelligence (AI) loom. This is on top of a new digital advertising framework, online safety regime, cyber strategy and the first voluntary code of practice for app developers (to name but a few).

With such a vast and complex array of policies underway, the Government must ensure that its overall approach in the coming year places sufficient emphasis on innovation and does not inadvertently weaken the UK technology sectors leading global position through over-regulation.

For example, care must be taken that any new data regime does not force UK businesses to sacrifice the ability to easily transfer data internationally for the sake of administrative savings in domestic transfers. The new digital markets regime should emphasise innovation and not be heavy-handed in its interventions. Any approach to AI should make sure that ethical standards are properly balanced with a facilitative environment for research and development.

All of these policies and workstreams have the potential to accelerate the UK’s technology leadership in 2023, but businesses must closely engage with Government to help ensure that they do not inadvertently do the opposite.

3. Continuing to drive investment into high growth technology businesses

The UK’s investment environment has arguably been the biggest driver of the success of the technology sector in the last decade. In the past five years alone, high growth technology companies in the UK have raised nearly £100 billion, which, as mentioned above, far outstrips the figures raised in other European markets.

And technology is proving a welcome outlier in the current economic climate in terms of attractiveness and confidence. The latest Deloitte survey of Chief Financial Officers in the UK, perhaps unsurprisingly, showed that organisations are downbeat about capital spending and hiring, with a net 62% and 59% of CFOs expecting their organisations to make cuts in these respective areas. This was in stark contrast to confidence about investment in digital technology and assets, with a net 79 per cent expecting an increase.

A facilitative environment for investing in these assets is crucial given the appetite that exists among UK businesses and investors. The expansion of R&D tax credits to cloud computing and data was a positive step in this regard, as was the expansion of Seed Enterprise Investment Schemes (SEIS) and the pledge (which must be fulfilled) to extend the sunset clause on Venture Capital Trust (VCT) relief.

In a difficult economic climate and with the upcoming rise in corporation tax, however, the Government must build on this and work hard to show that the UK continues to be open for business and investment in the technology sector. Even with the strong investment culture that exists in the UK, more can be done to support growing technology businesses as they look to become the unicorns of the future.

A wholesale review of tax reliefs and incentives has long been on the Government agenda and, should this take place, it should spend as much time examining how our tax system can incentivise further investment into our most innovative companies (particularly at scale-up stage, where gaps currently exist) as it does looking for ways to generate short-term savings for the Treasury.

If the Government takes an approach that prioritises skills, innovation and investment, there is no reason why 2023 should not be another bumper year for the UK’s technology sector.